Strong growth in care expenditure

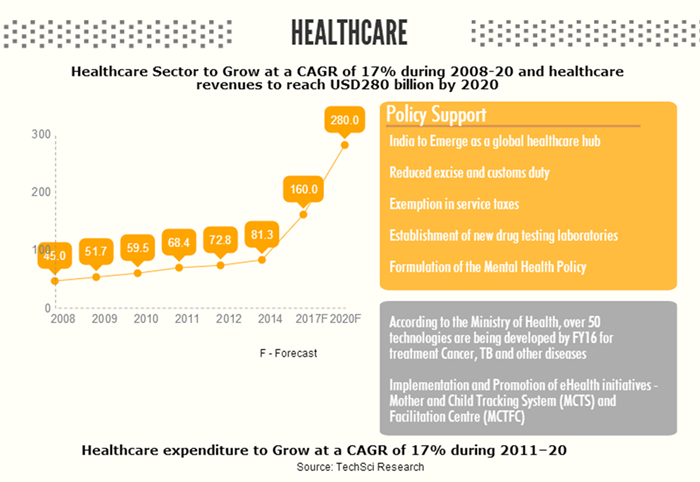

•Healthcare trade is growing at an amazing pace because of its strengthening coverage, services and increasing expenditure by public still personal players

•During 2008-20, the market is anticipated to record a CAGR of 17%

•The total trade size is anticipated to the touch USD160 billion by 2017 and USD280 billion by 2020

•As per the Ministry of Health, development of fifty technologies has been targeted within the FY16, for the treatment of malady like Cancer and TB

The Indian healthcare sector has been so far the fastest emergent sectors; it is expected to cross US$372 billion by 2022. As per reports, Indian Pharmaceutical sector that is estimated to account for around 3.6 percent of the global Pharmaceutical industry it is expected to grow US$100 billion by 2025. . India is the second largest contributor of the pharmaceutical workforce and is expected to be among the top three pharmaceuticals markets. The Indian pharmaceutical market that has marked the growth of CAGR Of 5.64% has increased from US$20.95 billion to US$25.75 billion from 2011-2016. On other hand, the government of India has put dedicated efforts to reduce the cost of the generic drug. The introduction of the generic drugs has proved to be the game changer. As these life-saving medicines have made life easier due to its easy availability and affordability.

The personal sector has emerged as a spirited force in India's care trade, loaning it each national and international repute. It accounts for pretty much 70% of the country’s total care expenditure. Telemedicines could be a fast-emerging trend in India; major hospitals (Apollo, AIIMS, Narayana Hrudayalaya) have adopted telemedicines services and entered into variety of public-private partnerships (PPP).The telemedicines market in Asian country is valued at US$ seven.5 million presently and is anticipated to grow at a CAGR of twenty per cent to achieve US$ eighteen.7 million by 2017.Further, presence of foremost hospitals and consummate medical professionals has reinforced India’s position as a most popular destination for medical touristry.

The Indian care manpower is anticipated to double to 7.4 million in 2022 from three.6 million in 2013, the report same.

The share of care FDI has virtually doubled since 2011, light the growing interest of foreign players within the sector, it added.

"Business opportunities" within the Indian care sector have exaggerated considerably and also the sector is anticipated to be one in all the foremost enticing investment targets for personal equity (PE) and working capital (VC) firms," the report same.

The FICC-KPMG report same that medical touristry has emerged as a powerful section owing to India's growing strength in supply.

The Government of {India|Republic of Asian country|Bharat|Asian country|Asian nation} aims to develop India as a worldwide care hub. it's created the National Health Mission (NHM) for providing effective care to each the urban and rural population. the govt is additionally providing policy support within the style of reduced excise and tariff, and exemption in commission tax, to support growth in care.

Investment in care infrastructure is ready to rise, benefiting each 'hard' (hospitals) and 'soft' (R&D, education) infrastructure.

References: Department of Industrial Policy and Promotion (DIPP), Union Budget 2012-13, RNCOS Reports, Media Reports, Press Information Bureau (PIB), #- as per PricewaterhouseCoopers - See more at: http://www.ibef.org/industry/healthcare-india.aspx#sthash.uzovV3Mq.dpuf, https://www.slideshare.net/NiteshBhele/indian-pharma-market-overview-2018

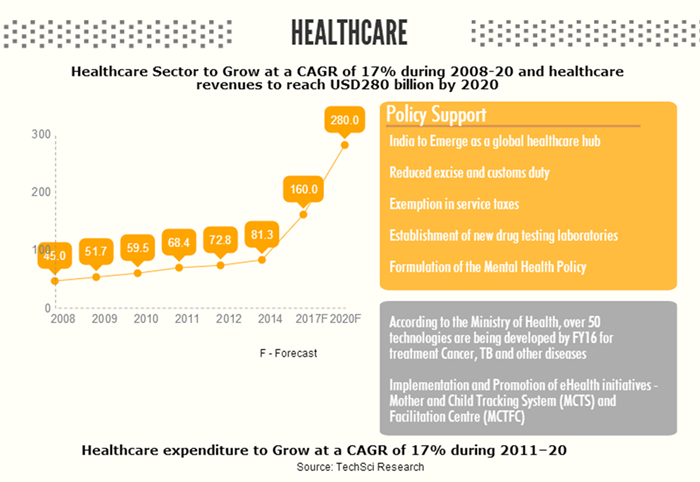

•Healthcare trade is growing at an amazing pace because of its strengthening coverage, services and increasing expenditure by public still personal players

•During 2008-20, the market is anticipated to record a CAGR of 17%

•The total trade size is anticipated to the touch USD160 billion by 2017 and USD280 billion by 2020

•As per the Ministry of Health, development of fifty technologies has been targeted within the FY16, for the treatment of malady like Cancer and TB

The Indian healthcare sector has been so far the fastest emergent sectors; it is expected to cross US$372 billion by 2022. As per reports, Indian Pharmaceutical sector that is estimated to account for around 3.6 percent of the global Pharmaceutical industry it is expected to grow US$100 billion by 2025. . India is the second largest contributor of the pharmaceutical workforce and is expected to be among the top three pharmaceuticals markets. The Indian pharmaceutical market that has marked the growth of CAGR Of 5.64% has increased from US$20.95 billion to US$25.75 billion from 2011-2016. On other hand, the government of India has put dedicated efforts to reduce the cost of the generic drug. The introduction of the generic drugs has proved to be the game changer. As these life-saving medicines have made life easier due to its easy availability and affordability.

The personal sector has emerged as a spirited force in India's care trade, loaning it each national and international repute. It accounts for pretty much 70% of the country’s total care expenditure. Telemedicines could be a fast-emerging trend in India; major hospitals (Apollo, AIIMS, Narayana Hrudayalaya) have adopted telemedicines services and entered into variety of public-private partnerships (PPP).The telemedicines market in Asian country is valued at US$ seven.5 million presently and is anticipated to grow at a CAGR of twenty per cent to achieve US$ eighteen.7 million by 2017.Further, presence of foremost hospitals and consummate medical professionals has reinforced India’s position as a most popular destination for medical touristry.

The Indian care manpower is anticipated to double to 7.4 million in 2022 from three.6 million in 2013, the report same.

The share of care FDI has virtually doubled since 2011, light the growing interest of foreign players within the sector, it added.

"Business opportunities" within the Indian care sector have exaggerated considerably and also the sector is anticipated to be one in all the foremost enticing investment targets for personal equity (PE) and working capital (VC) firms," the report same.

The FICC-KPMG report same that medical touristry has emerged as a powerful section owing to India's growing strength in supply.

The Government of {India|Republic of Asian country|Bharat|Asian country|Asian nation} aims to develop India as a worldwide care hub. it's created the National Health Mission (NHM) for providing effective care to each the urban and rural population. the govt is additionally providing policy support within the style of reduced excise and tariff, and exemption in commission tax, to support growth in care.

Investment in care infrastructure is ready to rise, benefiting each 'hard' (hospitals) and 'soft' (R&D, education) infrastructure.

India is the largest producer of the generic medicines and

successfully exports 20% of global exports in terms of volume. There is no

denying in the fact that with the passage of time Pharma Franchise in India has

marked a brisk growth. Despite the economic downturn condition, the franchising

industry in India has enjoyed successful growth. There is a range of sectors

for which the foreign companies are looking to get Franchise in India and the

reasons behind them are:

• Big market size- We all know that India

is land to a range of opportunities that let anyone reach at the zenith point

because of its overall market size. Foreign investors are very much interested

to establish their business in this developing country especially in PCD

Pharma. The success that has been gained by the Pharmaceutical industry insists

foreign investors to be part of this success.

• Availability of the skilled human Resources-

the other reason that has allured companies to set up their full-fledged setup

is easy availability of a highly professional and trained workforce.

• Affordable resources- what could be more cherishing than lesser

prices of investment? India is a land of resources and one can make a right use

of them by making right investments in the right resources. Here one can easily

get lower cost labor, power, and transportation.

• Use of high-end technology- Yes, India

is still said to be one of the developing countries but still it put every

possible effort to make the best productions. It has successfully got all the

latest apparatus and accessories for the continuous growth.

• Relaxation of policies- the other

positive aspect that attract investors is that to get Pharma franchise in India

you don’t have to really go through high-end conditions. Just look for the

people who are ready to take responsibility for doing all the paperwork.

• Increase in Export- As India is the

biggest exporter generic drugs; it has become the desired destination of

investors due to the cheap resources. Expanded export helps Indian

manufacturers to concentrate on the quality as PCD Pharma companies playing a

role of big brother for manufacturers.

Hence it has to be concluded that minimal cost of production

in the Pharma sector is giving a combative edge and bring forward opportunities

to Indian PCD Pharma company to enter into the overseas market.

References: Department of Industrial Policy and Promotion (DIPP), Union Budget 2012-13, RNCOS Reports, Media Reports, Press Information Bureau (PIB), #- as per PricewaterhouseCoopers - See more at: http://www.ibef.org/industry/healthcare-india.aspx#sthash.uzovV3Mq.dpuf, https://www.slideshare.net/NiteshBhele/indian-pharma-market-overview-2018